Discover our culture values and open roles. Real Estate Outlook Global Edition 2 - 2022.

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

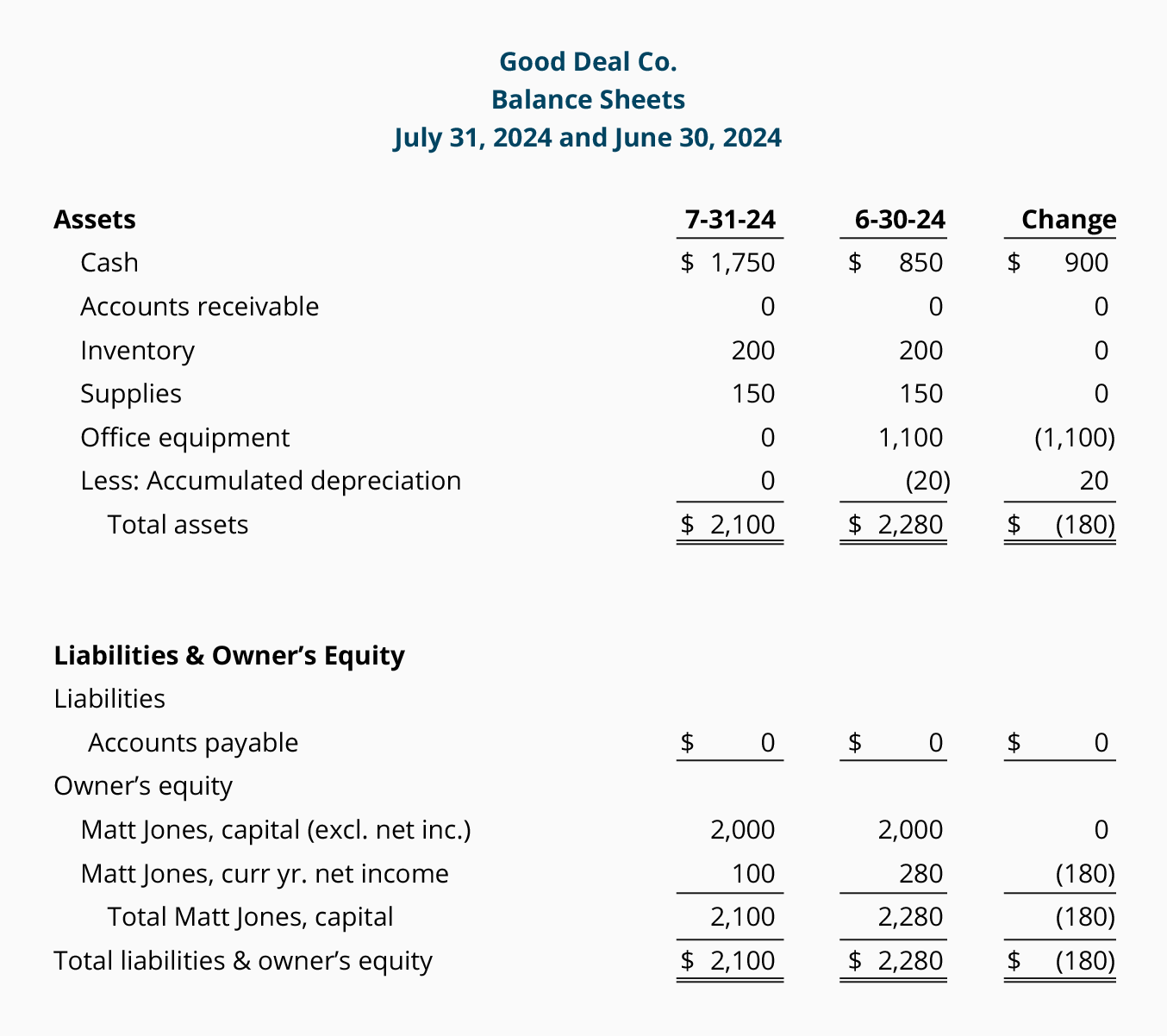

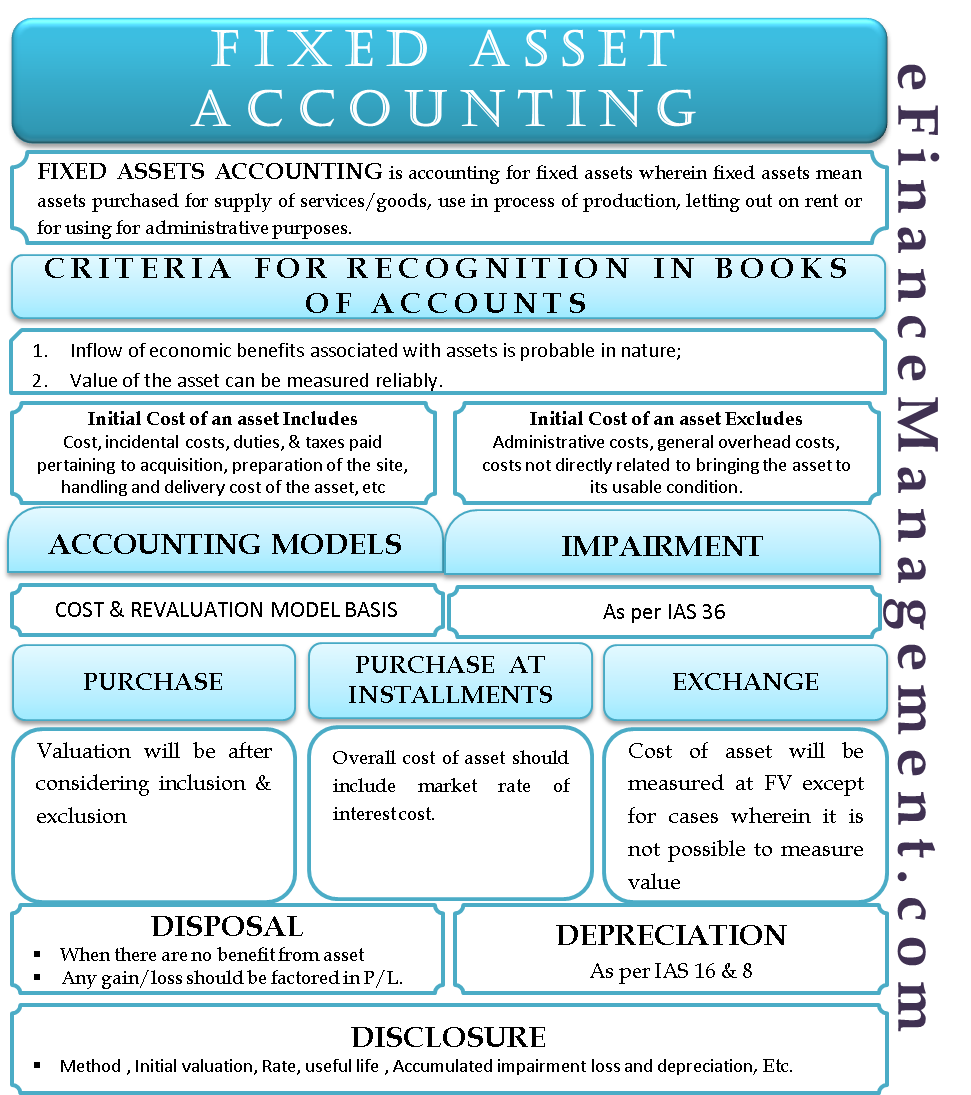

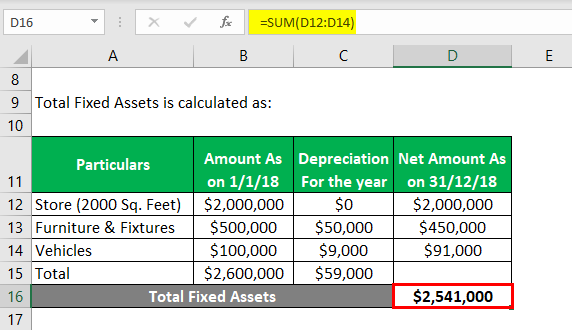

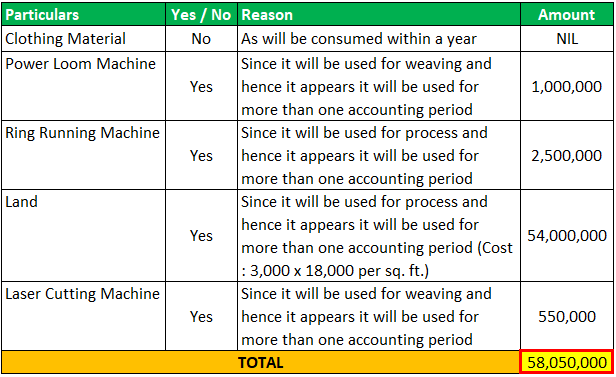

Hence all these assets are not included while computing fixed assets.

. Prepare a fixed asset account for the useful life of the. Meanwhile MG announced in a statement on June 7 that Low will become its head of fixed income in Asia Pacific. The machine was ready to use during May 2016 but actually put to use during June 2016.

Accounting for Disposal of Fixed Assets. When businesses file their income tax return they are able to. Jean Folger has 15 years of experience as a financial writer covering real estate investing active trading the economy and retirement planning.

Eastspring told AAM last month. Passing effect or lasting change. Real Estate Outlook Europe Edition 2 - 2022.

Washington Mutual will write down by 150 million the. A write-off is a deduction in the value of earnings by the amount of an expense or loss. Deferred tax assets are recognized as an asset in the balance sheet and are set off from the future tax liabilities of the company.

She is the co-founder of PowerZone Trading a. It is created because of timing differences between the book profits and the taxable profits of the company. During revaluation in March 2018 the asset appreciated by 20.

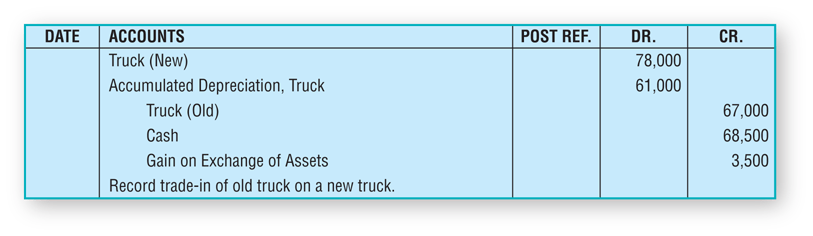

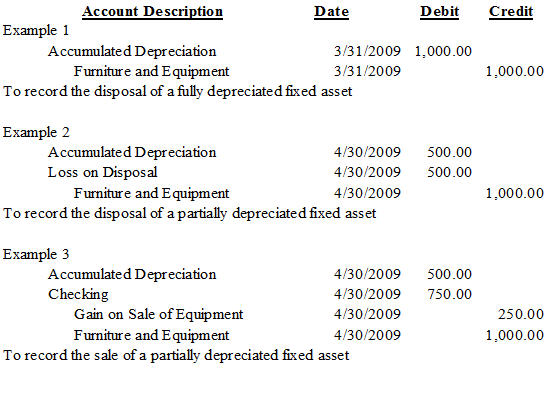

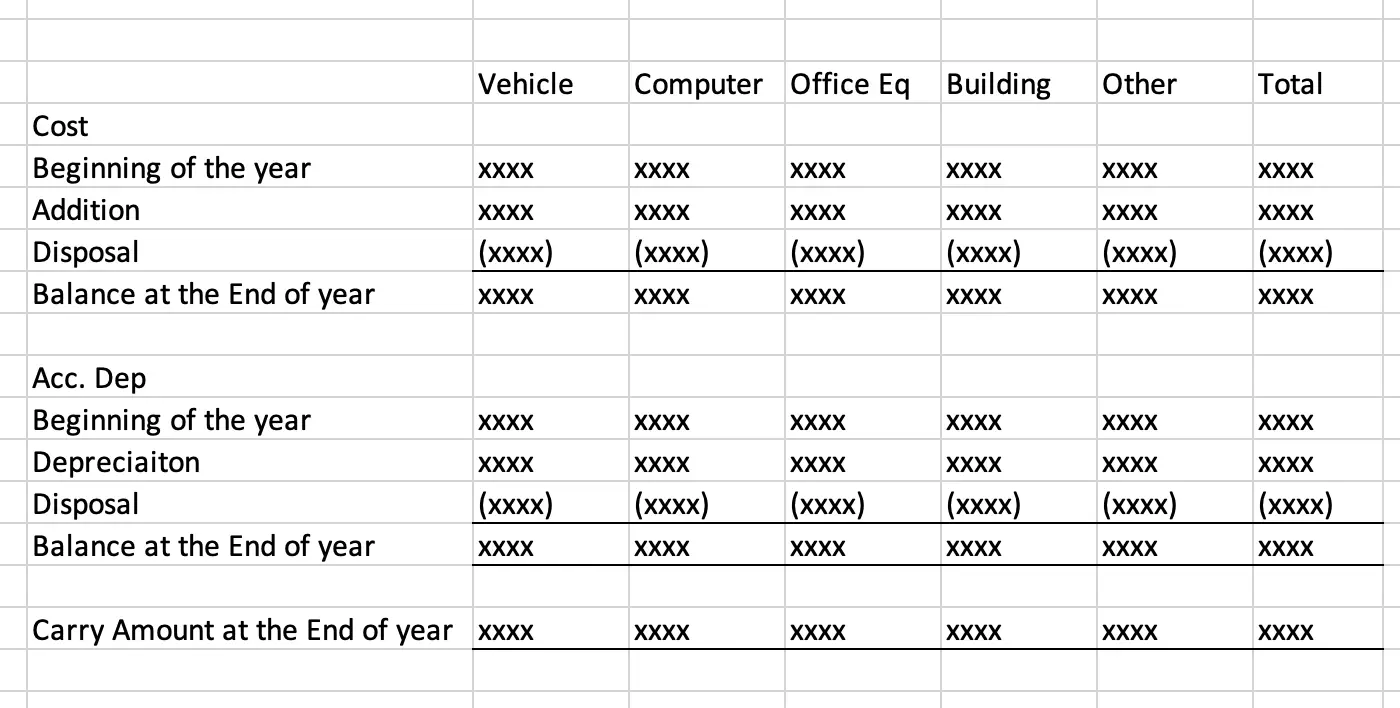

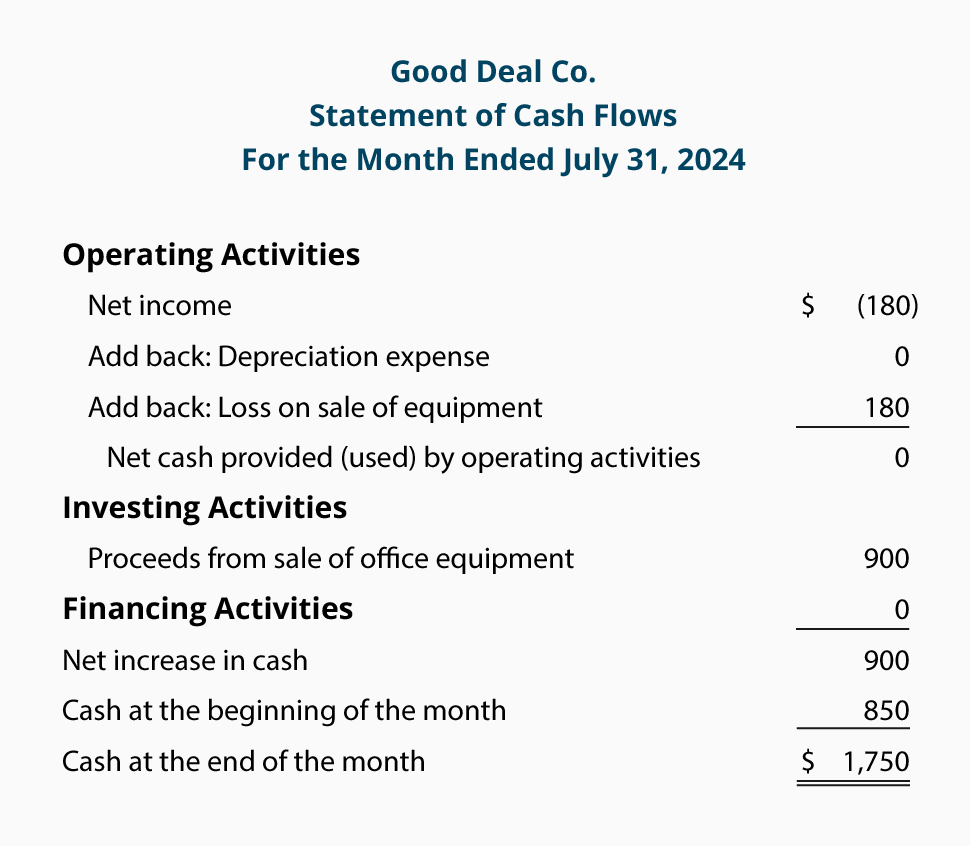

A disposal of fixed assets can occur when the asset is scrapped and written off sold for a profit to give a gain on disposal or sold for a loss to give a. Inventory is a noncurrent asset. Example 2 Fixed Asset Account.

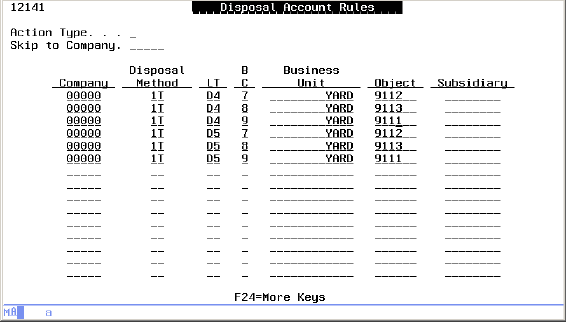

The distinction is that while a write-off is generally completely removed from the balance sheet a write-down leaves the asset with a lower value. When a business has a disposal of fixed assets the original cost and the accumulated depreciation to the date of disposal must be removed from the accounting records. MG says it plans to build out a fixed income investment team in the region and that Low who starts in the newly created position on July 25 will be.

For the purpose of income tax bad debts are allowed in the year when its actually written off. That these are decisions made independently by them for personal reasons. Build your career in asset management at UBS Asset Management.

As an example one of the consequences of the 2007 subprime crisis for financial institutions was a revaluation under mark-to-market rules.

How Do I Remove A Fixed Asset An Old Vehicle That

How Do I Remove A Fixed Asset An Old Vehicle That

Disposal Of Fixed Assets Procedure Example

Disposal Of Assets Disposal Of Assets Accountingcoach

Fixed Asset Accounting Examples Journal Entries Dep Disclosure

Fixed Asset Retirement And Disposal Crash Course In Accounting And Financial Statement Analysis Second Edition Book

Depreciation Nonprofit Accounting Basics

Work With The Fixed Asset Write Off Note

Fixed Asset Reconciliation Steps Movement Accountinginside

Fixed Asset Trade In Double Entry Bookkeeping

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

Draft Board Resolution For Writing Off Fixed Assets Of Company

Fixed Assets In Accounting Definition List Top Examples

Journal Entries For Retirements And Reinstatements Oracle Assets Help

Disposal Of Assets Disposal Of Assets Accountingcoach

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

Draft Board Resolution For Writing Off Fixed Assets Of Company